FORM W2/1099/42A806 FILING REQUIREMENTS FOR THE STATE OF KENTUCKY

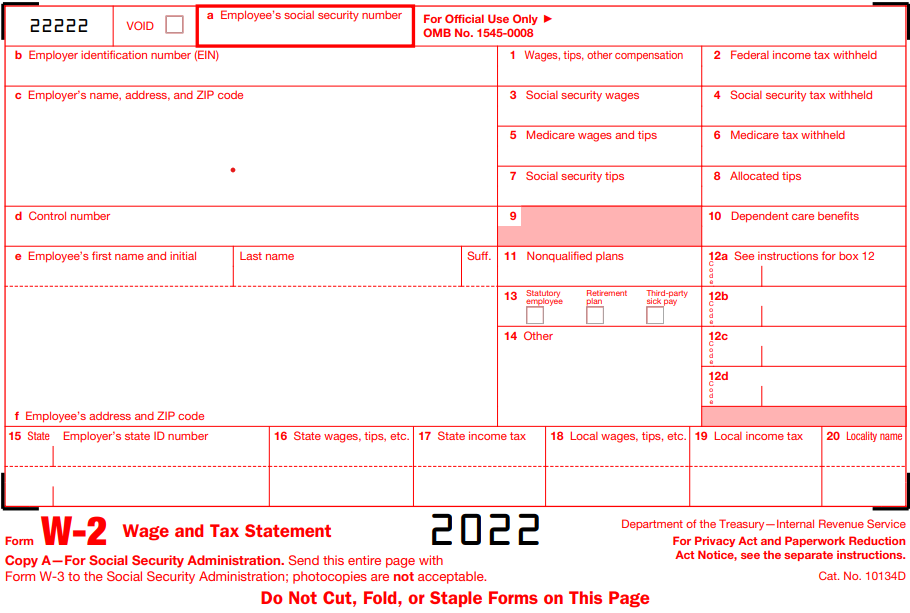

Form W-2

Kentucky mandates that employers submit Form W-2 to report an employee’s statement of wages and taxes including gross wages, social security, Medicare taxes withheld. The employers should file Form W2 electronically with the State agency only if there is a state tax withholding.

The State requires you file Form K-5 along with the W2 Forms.The Kentucky Department of Revenue accepts W2 information return via web-based filing or CD. A Transmitter Report, 42A806 must be included on CD Submission. It is not required for Web based filing. Visit revenue.ky.gov for more information about the Kentucky e-file specification and Contact information of

CD submission.

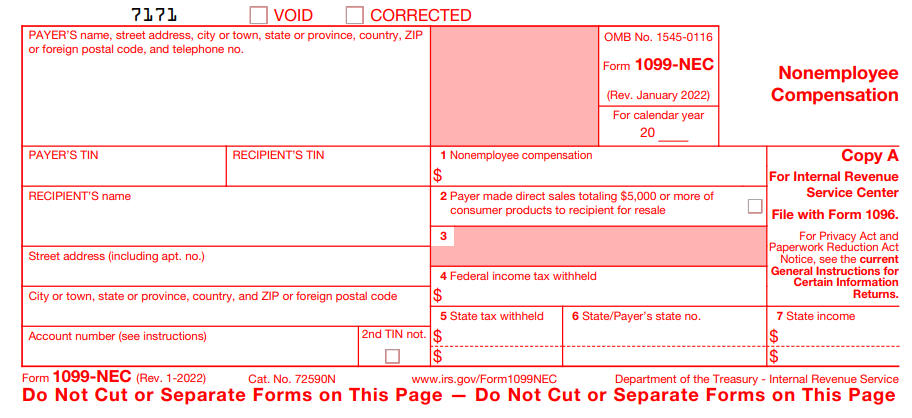

Form 1099

Kentucky mandates to file 1099 Forms directly with the State. Form 1099 reports the payments made to independent contractors, rents, royalties, fishing boats proceeds, interest income, dividends & distribution, real estate proceeds, etc.

The Kentucky state’s requires the following 1099 Forms

The State mandates to attaching the Form K-5 along with the 1099 Forms

if there is a State tax withholding. The State of Kentucky follows the IRS Specification with state defined fields in the B payee Record. The DOR accepts electronic 1099 information on CD only.

A Transmitter Report, 42A806, must be included with CD submissions.

Click here to know more about the 1099 e-file specification &

submission guide.

Form K-5: Annual Reconciliation Form

Kentucky state Employers must file the annual reconciliation (Form K-5) along with the W-2s/1099s. Wages/Taxes paid for the each quarters plus the tax due should reconcile with the total amount of Kentucky tax withheld as shown on the Forms W-2s/1099s.

DEADLINES TO FILE W2/1099/42A806 WITH FOR KENTUCKY STATE

Form W2

The deadline for filing W2 Form is

January 31, 2023

Form 1099

The deadline for filing 1099 Form is

January 31, 2023

Form 42A806

The deadline for filing 1099 Form is

January 31, 2023

If the due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

Avoid last minute stress by filing on time.

INFORMATION REQUIRED TO FILE FORM W2/1099/42A806 FOR KENTUCKY STATE

To complete the Form W2/1099, the following information needs to be readily available

| Employer/Payer Information | Employee/Recipient Information | Federal and State Details |

|---|---|---|

| Name, EIN/SSN, and Address. | Name, EIN/SSN and Address. | Total Wages, 1099-Payments, Federal & State income, and Withholdings. |

Kentuckytaxfilings.info— A Cloud Based E-filing Solution

Our e-file application helps you file the federal and state tax returns using a simple and secure filing process. Complete your filings quickly with the time-saving features available at our e-filing solution:

- Bulk upload: Upload your employee/recipient information at once with our Excel template, or use your own template with the same column. Learn More about

Bulk Upload Feature. - Postal mailing: We print and postal mail the W2/1099 copies to each of the employees/recipients on your behalf.

- Print center: Access the already filed W2/1099 returns from anywhere and at any time.

Businesses can easily file Form 941, 940, 944, 1095-B/C as well. E-filing starts as low as $1.99/form.

How to E-file W2/1099 with our cloud based Software

Registered for a free account and select the Form 1099/W-2 you want to e-file on our e-filing Software. Follow these steps to start the e-file process:

- Step 1: Enter employer/payer information

- Step 2: Enter employee/recipient information

- Step 3: Enter the wages & Tax withheld, 1099 payments

- Step 4: Review, pay and transmit the forms.

E-filing W2/1099 has never been simpler, you can complete your forms in minutes

| Where to mail Kentucky Form W2/1099 State Mailing address | |

|---|---|

| Form W-2 | Form 1099 |

|

Kentucky Department of Revenue, Electronic Media Processing, 501 High Street, Station 57, Frankfort, KY 40601 |

Kentucky Department of Revenue Electronic Media Processing 501 High Street, Station 57 Frankfort, KY 40601 |

Kentucky Paystub Generator

Whether you're in Louisville, Lexington, Bowling Green or anywhere in Kentucky state, our Kentucky paystub generator will calculate the taxes accurately. There is no need for desktop software. Save time and money with the paystub generator that creates pay stubs to include all company, employee, income and deduction information. Just follow the simple steps and email your paycheck stub immediately, ready for you to download and use right away.

Get Your First Paystub for Free

Contact Us

Reach us on the phone (704.684.4751), email (support@taxbandits.com), and live chat for a quick assistance on e-filing your tax returns and tax related queries.

We are here to support you directly from

SPAN Enterprises LLC2685 Celanese Road,

Suite 100, Rock Hill, SC 29732.